Table of Contents

Are you not sure if job loss insurance is right for you? Or do you know if you even qualify? You’re not alone. With so many different work situations today, from full-time office jobs to freelancing and gig work, it’s essential to understand who job loss protection is really for.

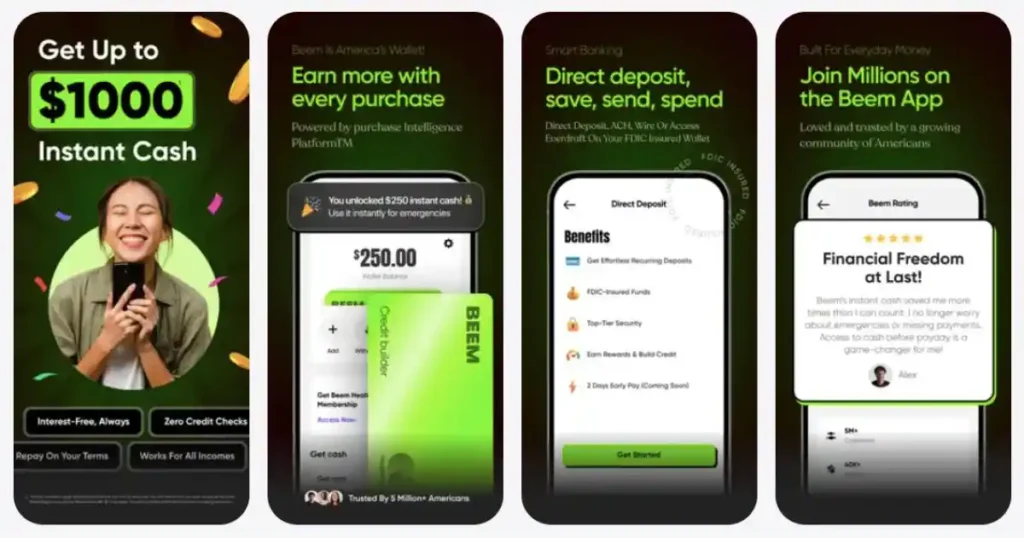

Traditional job loss insurance often has many requirements that many people don’t meet. But the good news is that modern options like Beem are changing the game. They also offer financial support to a broader range of workers without all the red tape.

Whether you’re working 9-to-5, driving for a delivery app, or juggling freelance gigs, there’s likely a solution that fits your lifestyle. Let’s break down who qualifies with the help of this article. This way, you can explore how to get the necessary coverage without the hassle.

What Is Job Loss Insurance and Why Does It Matters

The Financial Safety Net In Uncertain Times

Life doesn’t stop when your paycheck does. Job loss insurance gives you breathing room when income suddenly disappears. It helps you avoid missed payments, late fees, or digging into savings. It’s beneficial if you lack employer-provided benefits or your emergency fund won’t cover you long-term. Simply put, it gives you time to get back on your feet—without added financial stress.

Job Loss Insurance Vs. Traditional Unemployment Benefits

Government unemployment benefits can take time to process. It often replaces only a massive chunk of your overall income. They’re also limited to certain types of job loss. Also, it may not be available to freelancers or gig workers. Job loss insurance, especially from modern providers, can offer faster, more flexible support. These help fill in the gaps where traditional programs fall short.

Beem’s Approach To Proactive Income Protection

Beem is rethinking how job loss protection should work. Instead of slow claims and strict rules, it provides instant access to cash through tools. These include features like Everdraft™ and Instant Cash. There’s no paperwork or waiting time. Additionally, there are no employment-related restrictions. Whether you’re laid off, between gigs, or just need short-term help, Beem gives you the flexibility. This also offers confidence to move forward without the financial panic.

General Eligibility Criteria

Employment Status: Who Needs To Be Working Full-Time?

Most traditional job loss insurance policies require you to be employed full-time. It is mainly for those in a W-2 position. It usually involves working a minimum of 30 to 40 hours per week. These policies are designed for people with stable, ongoing employment.

However, modern alternative tools like Beem can set you free. They will effortlessly break away from these limitations. Beem is built for gig workers, freelancers, part-timers, and even self-employed individuals. It offers income support regardless of your job type.

Duration Of Employment: How Long Should You Be Employed?

Traditional providers often require that you’ve been employed continuously. It must be 6 to 12 months before you can qualify for coverage. This ensures the insurance company isn’t covering someone who just started or is already at risk of being let go.

With Beem, no minimum job duration is required. It’s designed to provide financial help without making you jump through hoops or prove a long-term employment history.

Type of termination: Layoffs vs. voluntary quits

To qualify for traditional job loss insurance, your job loss must be involuntary, typically due to:

- Layoffs

- Company restructuring

- Business closure

You’re not eligible if you:

- Quit voluntarily

- Are fired for misconduct

- Retire or leave for personal reasons

Beem doesn’t require you to prove the reason for job loss. It can be that your hours were cut, your gig slowed down, or you’re just between jobs. Beem is there to support you instantly. There are no questions asked.

Read related blog: Job Loss Insurance for Self-Employed: What You Need to Know

Residency And Legal Status: US Citizen Or Legal Resident

Most traditional job loss insurance providers require you to be a U.S. citizen. They at least need a legal resident to qualify. This is also true for government unemployment benefits.

Beem follows a similar standard. To use the app and its financial tools, you must reside in the U.S. and have a valid ID or account with a U.S.-based financial institution. There’s no complex application process; it’s a simple sign-up process with quick access to help when needed.

Factors That May Disqualify You

Voluntary Resignations Or Quitting Without Cause

If you quit your job voluntarily, you’re generally not eligible for traditional job loss insurance. This includes:

- Leaving for personal reasons

- Taking a career break

- Resigning without being forced by circumstances

Traditional insurers view voluntary quits as a personal choice, not an insurable risk. In contrast, Beem doesn’t require proof of termination type, so you can still receive support even if you left your job on your terms and need time to find something new.

Termination For Misconduct Or Fraud

If you are being fired for cause, it will also affect your insurance. It will typically disqualify you from receiving job loss insurance benefits. It can be misconduct, poor performance, policy violations, or fraud. Insurers are unlikely to pay out if the termination is linked to behavior under your control.

Beem’s tools, however, don’t rely on traditional employment verification or the reason for job separation. You can still access emergency funds when you need them. This is possible even if your departure wasn’t ideal.

Seasonal Or Contract-Only Workers (With Exceptions)

Traditional insurance policies often exclude seasonal employees, short-term contractors, and temporary workers. This is because their job endings are usually expected. If your work is time-limited, insurance providers may not consider your job loss “unexpected.”

That said, Beem welcomes gig workers, freelancers, and part-timers. It offers financial support without requiring long-term or permanent job status.

Gaps In Employment History Or Insufficient Income

Some traditional policies require a consistent employment record and a minimum income level to qualify for coverage. You may be denied coverage if you’ve had long gaps between jobs or a very low or unstable income.

Beem doesn’t factor in your past income or employment gaps. Instead, it focuses on providing you with fast access to help when you need it. This is regardless of your work history. That makes it an ideal solution for individuals with non-traditional or irregular work schedules.

Read related blog: How to Supplement Job Loss Insurance with Other Benefits

Job Loss Insurance for Non-Traditional Workers

Gig workers and freelancers: Can they qualify?

Traditional job loss insurance rarely covers gig workers like rideshare drivers, delivery couriers, or freelance creatives. This is because there is no formal employer or guaranteed income stream to insure.

But Beem is different. It’s designed to support workers in the gig economy by offering:

- Instant access to cash when income slows down

- No need for employment verification

- Eligibility based on financial activity, not job titles

If you hustle across multiple platforms or take freelance gigs to make ends meet, Beem provides a flexible, reliable safety net.

Self-Employed Individuals: Are There Any Options?

Self-employed people usually fall through the cracks with traditional insurance. In such cases, you’re both the boss and the employee. This means you typically can’t access unemployment benefits or employer-sponsored coverage.

With Beem, self-employed workers can:

- Access Everdraft™ and Instant Cash without needing to prove job loss

- Get real-time financial support when business slows

- Use tools tailored for variable income flows

No credit checks or income minimums are required, making it a practical option for entrepreneurs, consultants, and solo business owners.

How Beem Bridges The Gap For These Workers

The platform was built to fill the gap left by traditional coverage. It doesn’t require a steady paycheck or employer relationship to work. Instead, it gives non-traditional workers:

- Fast, app-based access to emergency funds

- Support without claims, forms, or red tape

- Peace of mind during slow seasons or unexpected income dips

Read related blog: Building a Budget After Losing Your Job

Understanding Beem’s Qualification Process

Who can use Everdraft™ and Instant Cash features?

Beem is an excellent option if you do not have financial backup from other traditional sources. As a gig worker, freelancer, part-time or even full-time employee, you can explore Beem’s tools to get financial security. Self-employed people should also consider Beem and its Everdraft feature a must-have.

To access Everdraft™ and Instant Cash, users simply need to:

- Be 18 or older

- You must have a U.S.-based bank account

- Connect their bank to the Beem app for income/activity tracking

- Use the app regularly to build trust and unlock higher amounts over time

There are no employment-type restrictions. This is so Beem works well even if your income is irregular or based on gigs.

What Makes Beem More Accessible Than Traditional Insurers?

Traditional insurers usually require:

- Full-time W-2 employment

- Credit and background checks

- Proof of involuntary job loss

- Long applications and waiting periods

Beem skips all of that. You don’t need to prove why you need help. You don’t have to be employed a certain way or for long. Beem focuses on your current financial activity, not your past employment or credit score. This makes it far more accessible in modern, flexible work situations.

Minimal Paperwork, Fast Approval, And No Medical Underwriting

With Beem, there’s:

- No medical exams or health questions

- No paperwork to fill out

- No claim forms or employer documentation

- No waiting period to access core features

Everything happens through the Beem app. And approvals for tools like Instant Cash happen in minutes. That means you get the support you need when you need it. It is not weeks later.

Read related blog: Smart Financial Moves After Losing Your Job

How Beem Compares to Traditional Insurers

Beem vs AFLAC

AFLAC offers supplemental insurance through employers, including limited job loss coverage tied to specific events like layoffs. It requires:

- Employer-sponsored enrollment

- Proof of involuntary job loss

- Waiting periods before benefits kick in

Beem simplifies all of this. There’s:

- No employer needed

- No paperwork or proof of termination

- Instant access to cash through Everdraft™ and Instant Cash

Perfect for people who need support fast—without jumping through hoops.

Beem vs Allstate

Allstate’s job loss coverage often comes bundled with mortgage or debt protection plans and may only cover your loan payments, not daily living expenses. It typically requires:

- Employment verification

- Documentation of job loss

- Time-consuming claims processing

Beem, by contrast:

- Covers any expense—not just debt

- Doesn’t limit support to homeowners or borrowers

- Offers instant, app-based access without red tape

- Beem vs State Farm

State Farm may offer job loss coverage, but only as an add-on to existing policies like auto or home insurance. Like others, it includes:

- Strict employment eligibility

- Minimum employment duration

- Delayed payouts after claim approval

Beem removes these barriers:

- No bundling required

- No waiting periods or formal claims

- Designed for anyone—from full-timers to gig workers

Flexibility, Speed, And Accessibility Differences

Flexibility

- Beem: It is built for all kinds of workers. It can be a full-time, part-time, freelancer, or a gig worker. It is suited for even those between jobs. There’s no need to fit into a narrow definition of employment.

- Traditional Providers: Usually limited to full-time W-2 employees with long, stable job histories. Gig and contract workers are typically excluded.

Speed

- Beem offers instant access to funds through tools like Everdraft™ and Instant Cash. There are no waiting periods, no claims to file, and no approval delays.

- Traditional Providers: Payouts can take weeks, often requiring a 30–90 day waiting period after job loss, plus time for claim review and approval.

Accessibility

- Beem: 100% app-based, easy to set up in minutes, with no credit checks, no paperwork, and no need to go through an employer.

- Traditional providers often require manual applications and proof of job loss, and they must sometimes be purchased through an employer or bundled with other policies.

Read related blog: Health Insurance Considerations After Job Loss: Your Best Guide

How to Improve Your Eligibility for Coverage

Maintaining Steady Employment

Traditional job loss insurance often requires a consistent work history. It is usually 6–12 months of full-time, W-2 employment with no significant gaps. Keeping steady hours and maintaining continuous employment can improve your chances of qualifying for those plans.

If your work is more flexible or freelance-based, platforms like Beem don’t penalize you for inconsistent work. However, having regular income activity can still help you access more features. This includes benefits like higher Instant Cash limits or improved access to Everdraft.

Avoiding Risky Termination Scenarios

To stay eligible for most job loss coverage, you must avoid quitting without cause. It is also great if you are not being terminated for misconduct. Traditional insurance won’t pay out in these cases. Maintaining open communication with your employer is essential. Addressing issues promptly can help you avoid potential problems. This might jeopardize your eligibility.

Even though Beem doesn’t require proof of termination type, maintaining professionalism and a clean work record can still be helpful. This is especially true when transitioning between jobs or applying for other financial support.

Building An Emergency Fund Alongside Job Loss Insurance

Job loss protection is a great tool. But it works best when paired with a personal emergency fund. If you can, save 3–6 months’ living expenses. That way, if you face a more extended period without income, you’ll have multiple support layers: Beem for instant help, and your savings for longer-term stability.

This combo gives you quick access to cash and the peace of mind from being truly prepared.

Read related blog: The Psychological Impact of Job Loss and How to Cope

FAQs About Job Loss Insurance Eligibility

Can part-time employees qualify for job loss insurance?

Most traditional job loss insurance policies are limited to full-time, W-2 employees. Part-time workers often don’t meet the minimum hours or income requirements. This may be excluded from coverage.

Beem, on the other hand, is designed to be more flexible. It offers a solution whether you’re working part-time, freelance, or doing gig jobs. Beem still provides instant financial support through tools like Everdraft™ and Instant Cash. This comes with no need to meet strict job-type criteria.

What happens if I’m on probation at work?

Traditional insurance may not cover you if you’re on probation (usually the first 30–90 days of a new job). Many policies require you to be employed for some time before becoming eligible.

With Beem, there’s no probation restriction. You can access financial help anytime. This is whether you’re new to a job, between roles, or building your career from scratch.

Can I get coverage if I’ve been recently laid off?

Traditional insurers won’t cover you if you’ve already been laid off. It also does not cover if you know a layoff is coming when you apply.

However, Beem doesn’t require you to predict the future or prove the timing of your job loss. Beem’s tools can offer immediate support if you’re in need. This is even if you’ve already been laid off.

Does Beem check my credit or employment history?

Nope. Beem doesn’t require a credit check or a deep dive into your work history. It’s built for speed, privacy, and inclusivity. Whether you’ve had gaps in employment or don’t have perfect credit, Beem can still help you with on-demand financial tools.

Is there a waiting period before coverage starts?

With traditional job loss insurance, there’s usually a 30 to 90-day waiting period after purchasing the policy before coverage kicks in. There is another waiting period after job loss before benefits begin.

Beem eliminates the wait. Once you set up your account, you can access support almost instantly. There’s no long delay—just quick help when needed.

Know Where You Stand Before You Need Help

Job loss can happen to anyone. But not everyone qualifies for traditional job loss insurance. That’s why it’s essential to understand the key eligibility factors. It must be done before you find yourself in a financial crunch. Most traditional plans require full-time W-2 employment, steady work history, and proof of involuntary job loss. You may be out of luck if you’ve quit, been fired for misconduct, or work seasonally or as a contractor.

That’s where Beem comes in. Unlike traditional providers, Beem offers inclusive, real-time financial support. This is useful no matter your job title or employment status. Whether you’re a gig worker, freelancer, self-employed, or between jobs, Beem is built to provide fast, flexible help. It comes with no credit checks, no paperwork, and no waiting.

Don’t wait for the unexpected to hit. Download Beem today to see if you qualify for instant cash assistance and job loss protection—and take control of your financial future with confidence.