Table of Contents

Knowing how to compute your salary daily is essential for freelancers, part-timers, and those considering switching from a monthly salary structure. Understanding how to break down your salary daily gives you clarity regarding budgeting, money management, and contract negotiations. Let’s examine the fundamentals, the computation procedure, and the variables influencing your daily pay. How to calculate salary per day? This blog is your ready reckoner. Let’s get started.

Basics of Daily Salary Calculation

The first step in calculating your daily salary is understanding the components of your overall compensation. Typically, salaries are paid monthly or annually, and converting them into a daily wage requires a bit of arithmetic. A daily salary calculation helps you determine how much you’re earning each day based on your contractual salary and working schedule.

This method can be helpful when working with irregular schedules or needing a clearer understanding of how your income adds up daily.

The Simple Formula for Calculating Daily Salary

The simple formula for calculating daily salary is straightforward: divide your annual salary by 365 (days in a year) or your monthly salary by 30 (average days in a month). For example, if your annual salary is $36,500, your daily pay would be approximately $100 ($36,500 ÷ 365). If your monthly wage is $3,000, dividing by 30 gives you $100 daily. This formula offers an easy way to understand your daily income, clearly showing your earnings and helping with financial planning.

Examples of Daily Salary Calculations

You can apply the formula to calculate your daily salary using either your annual or monthly income. For instance, if your yearly salary is $60,000, divide it by 365 days to get a daily wage of approximately $164.38. Alternatively, if you earn $5,000 a month, divide that by 30 days to get around $166.67 daily. These calculations help clarify your earnings and assist in better financial planning, whether you’re budgeting or tracking income for freelance or part-time work.

Factors That Affect Daily Salary Calculations

Several factors can influence your daily salary, especially regarding your employment type, the number of working hours, or your contract terms. Some key factors include:

- Number of Working Days in a Month: Some months, you might have fewer working days than others, depending on weekends or holidays. For instance, a month with 20 working days will lead to a higher per-day wage than a month with 22 working days.

- Full-time vs. Part-time Employment: Full-time workers typically work five days a week, while part-time employees may work fewer hours or days. Because part-time workers have fewer work hours, their daily salary will be calculated differently.

- Contractual Terms: Some employers might calculate the daily wage differently, such as accounting for shifts, breaks, or the working hours per week.

How to Account for Overtime and Bonuses

When calculating your daily salary, you might need to factor in overtime pay or bonuses, which can significantly impact your income. Overtime is typically paid at a higher rate than regular hourly wages.

- Overtime Pay: For example, if your hourly rate is $20, and overtime is paid at 1.5 times your hourly rate, your overtime rate would be $30 per hour.

- Bonuses: Bonuses can be annual, quarterly, or one-time payments. If you receive a yearly bonus of $2,000, you could divide it by 365 to get a daily bonus of about $5.48.

Add these amounts to your daily salary for a more accurate calculation.

Tools and Resources for Salary Calculations

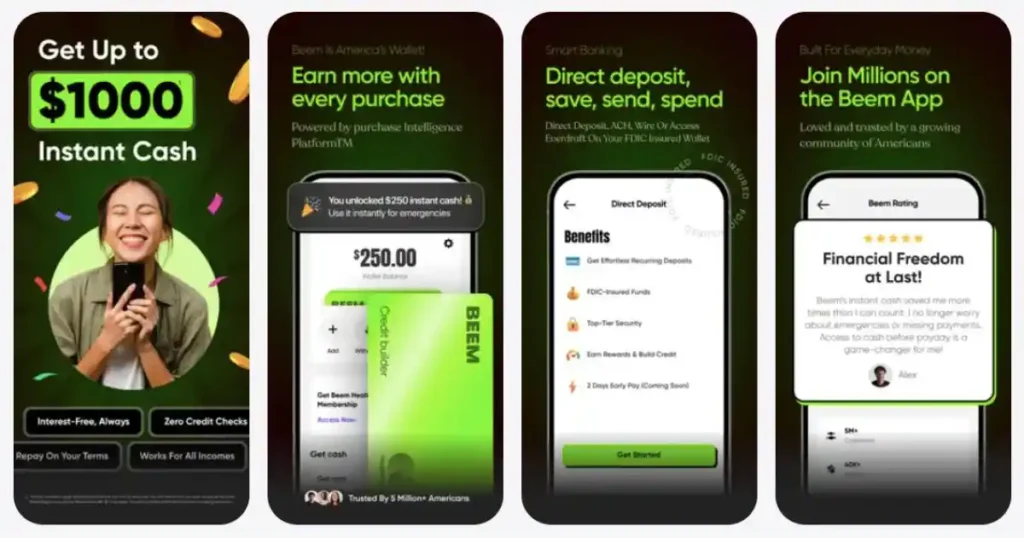

While manual calculations work well, various online tools and apps simplify the process. Salary calculators, such as Beem, provide quick and accurate estimates. These tools consider variables like hourly rate, overtime, and bonuses, saving time and ensuring accuracy. Beem can also help track your daily salary over time, providing invaluable financial insights for managing your expenses.

Daily Pay vs Monthly Pay: Which is Better?

When deciding between daily and monthly pay, there are a few things to consider:

- Consistency: Monthly pay is more predictable, offering a set amount each month, which can be more convenient for budgeting.

- Flexibility: Daily pay might benefit those with irregular hours or freelancers who need to track their daily earnings, such as in industries like consulting or freelance work.

Ultimately, it depends on your preference and financial situation. Monthly pay may be better for stability, while daily pay may be ideal if your income fluctuates.

How to Calculate Daily Pay from Monthly And Yearly Pay

However, calculating any income from an app or some organization using a formula with steps is crucial. Therefore, to calculate your daily pay from your monthly or yearly income, follow these simple steps:

- From Monthly Pay: Divide your monthly salary by 30. This roughly estimates your daily earnings, helping you budget daily expenses.

- From Yearly Pay: Divide your annual salary by 365 to get your daily earnings. This gives you an accurate daily wage for annual salary calculations.

Common Mistakes to Avoid When Calculating Daily Salary

When calculating your daily salary, avoid common mistakes to ensure accuracy and fairness.

Incorrect Days in a Month: Using 30 days every month can lead to inaccuracies. Account for months with 31 or fewer days.

Excluding Non-working Days: Don’t forget to subtract holidays or unpaid leave from the total days worked, as this affects daily earnings.

Not Adjusting for Overtime: If you receive overtime pay, include it in your calculations for a more accurate daily salary reflection.

Misunderstanding Salary Types: Ensure you know whether your salary is gross or net, as this can affect your daily wage calculation.

How Beem Can Help Manage Your Daily Salary

Beem helps manage your daily salary by offering instant access to funds when needed. Through its user-friendly platform, you can quickly track your earnings and access emergency cash, making it easier to manage daily expenses. By integrating financial flexibility and ease of use, Beem ensures you never have to wait for payday in case of urgent needs. It’s a great tool for maintaining economic stability daily.

Conclusion

Making the most of your daily wage requires effective budgeting, smart spending, and planning for unexpected expenses. By understanding your daily earnings, you can make informed financial decisions and avoid living paycheck to paycheck.

For any financial aid, you can check out Beem, a smart wallet app trusted by over 5 million Americans with features from cash advances to help with budgeting and tax calculations. In addition, Beem’s Everdraft™ lets you withdraw up to $1,000 instantly and with no checks. Download the app here.

FAQs for How to Calculate Salary Per Day

What is the basic formula for calculating daily salary?

Divide your annual salary by 365 (or the number of working days in the year) to get your daily salary.

How can I account for overtime and bonuses in my daily salary calculation?

Add any overtime pay and bonuses to your annual salary, then divide by 365 to get a more accurate daily rate.

What factors can affect my daily salary?

Factors like unpaid time off, overtime, bonuses, and the number of workdays in a year can affect your daily salary.

Are there tools that can help me calculate my daily salary?

Yes, online calculators, spreadsheet tools, and apps like Beem can assist with daily salary calculations and financial tracking.

What are common mistakes to avoid when calculating daily salary?

Pay attention to overtime bonuses or taking inaccurate workdays into account, which can result in an incorrect daily salary calculation.

How does Beem assist with managing daily salary?

Beem helps track daily earnings, manage expenses, and ensure you stay within budget by providing real-time salary and spending insights.