Table of Contents

Planning education costs today is as much about software and marketplaces as it is about spreadsheets and discipline. The right tools speed up scholarship searches, automate savings, reduce fee drag, and, crucially, spot timing gaps before they become emergencies.

This guide shows the modern toolbox parents and students can use in 2025: budgeting apps, high-yield places to park short-term funds, scholarship search platforms, forecasting and cash-flow tools, loan and HYSA marketplaces, and AI helpers that make repeated decisions easier. We also explain ways to combine tools (so you don’t end up with 12 apps and zero clarity) and how Beem’s products fit this stack.

Why tools matter more now than ever

Good tools remove busywork, surface risk early, and make small wins repeatable. Instead of manually checking five bank accounts each month, you want one place that shows: “Is the next tuition deposit covered? If not, by how much?”

Tools help you answer that in minutes. When used well, they cut fees, improve returns on parked cash, and free up time for higher-value work like scholarship applications or negotiating payment plans.

What a complete 2025 toolbox looks like

Budgeting & cash-flow tools (the backbone)

These are the apps that track income, bills, and “safe-to-spend” balances. Look for:

- Reliable bank linking in read-only mode.

- Forward-looking cash-flow (next 30–90 days) so you match paydays to deposit windows.

- Alerts for upcoming tuition or renewal dates.

Examples include mainstream budgeting apps and newer AI-driven wallets. Tools vary in depth: some show one clear “safe-to-spend” number, others give deep category breakdowns. These apps are your day-to-day dashboard, not your one-time plan.

High-yield savings (where to park near-term deposits)

Short-term deposits and tuition deposits should sit in low-risk, liquid accounts that still earn decent interest. Compare HYSA offers regularly; small APY differences compound over 12–36 months. Financial roundups and product lists show competitive HYSA options remain attractive in 2025.

Scholarship & grant search platforms

Treat scholarship discovery like job hunting. Use a mix of:

- national aggregators for broad matches,

- university or program-specific portals,

- local/community foundation listings.

Maintain a spreadsheet that syncs to deadlines and required materials so you can batch applications efficiently.

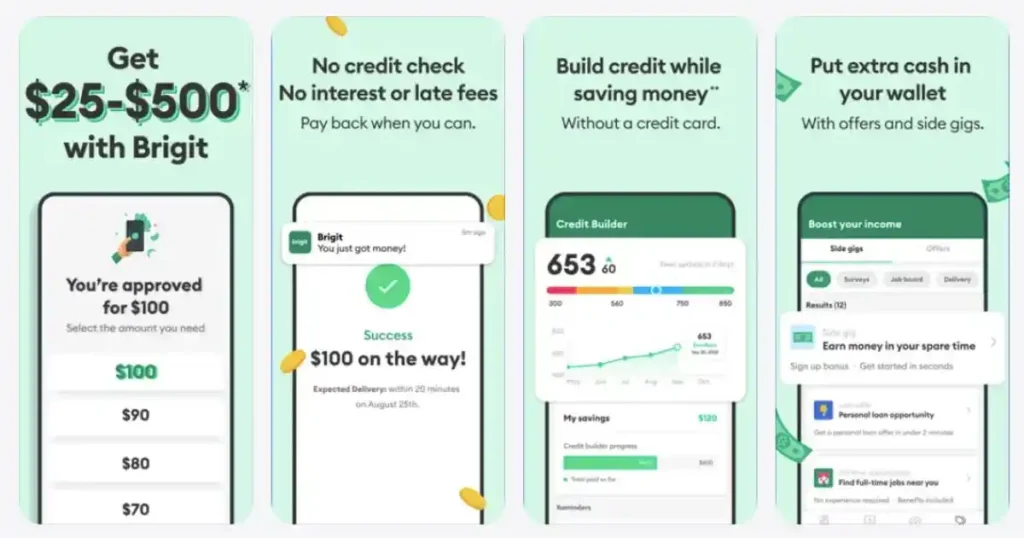

Loan & marketplace comparison tools

When borrowing looks unavoidable, a marketplace that surfaces multiple personal loan offers or student-friendly options prevents costly one-off choices. Compare APR, fees, and flexibility, and factor in total cost over the repayment term. Beem’s Marketplace speeds this comparison and often reveals lower-cost credit union or regional options you might miss.

Forecasting & scenario planners

These let you model “what if” scenarios: what if tuition rises 4% per year, or you win a $2,000 scholarship, or your bonus declines next year? Scenario tools are essential because education planning isn’t static. Good planners simulate multiple outcomes and produce a recommended monthly transfer under each scenario.

Scholarship-automation helpers

Not all tools are about money. Tools that automate application tracking, save customized essays, and remind you of deadlines transform scholarship hunting from random to repeatable work.

Receipt capture & documentation (taxs & audit trail)

Keep digital receipts for tuition, qualified expenses, and tax documents. Receipt scanning apps with OCR make it simple to compile records for refunds, audits, or 529 documentation.

How AI changes the game in 2025

AI can:

- Suggest optimal saving splits between HYSA vs investment accounts based on timeline.

- Auto-tag recurring charges that leak money (and suggest cuts).

- Forecast shortfalls weeks ahead so you can negotiate a payment plan rather than scramble.

Use AI suggestions as inputs, not as autopilot decisions. Always scan recommendations for context. Your family’s preferences and risk profile matter more than any model.

| AI Capability (2025) | What It Does | How It Helps Families |

| Tuition Inflation Forecast | Predicts annual tuition increase by region | Prevents under-saving and allows early correction |

| Behavioral Nudging | Recommends micro-actions (save $20, cut subscription) | Builds sustainable long-term habits |

| Scholarship Match Modeling | Suggests relevant scholarships based on profile | Increases win rate and reduces wasted effort |

| Expense Pattern Detection | Flags unusual outflows | Keeps cash flow steady and predictable |

| Automated Goal Adjustment | Adapts savings targets to new income or fees | Keeps plan relevant without manual recalculation |

The Next Wave: Predictive Planning and AI Personalization

The coming phase of educational planning is predictive.

AI models in 2025 can now forecast tuition inflation, scholarship likelihood, and household affordability scenarios using live data.

They’ll soon integrate with policy updates, regional tuition changes, and market shifts to adjust your targets automatically.

For families, this means fewer reactive scrambles and more anticipatory control. Imagine a tool that tells you six months in advance, “Your tuition fund will fall short by $600. Transfer $50 more per month now to stay on track.”

Beem’s Smart Wallet and other AI-driven money planners already hint at this direction: personalized, adaptive systems that evolve with you. Here’s more on How Much to Save for College? Comprehensive Guide.

How to combine tools without adding chaos

- Choose one source of truth. Pick the app or sheet you’ll use to make decisions and consolidate numbers there.

- Limit supporting apps to 2–3 roles: one for forecasting/cash flow, one HYSA marketplace, and one scholarship tracker.

- Automate flows between them where possible (scheduled transfers, alerts).

- Monthly 10-minute ritual. Reconcile in 10 minutes: check forecast, scholarship progress, and HYSA balance.

Practical stack suggestions (example setups)

Minimal setup (low effort)

- Primary budgeting app that shows safe-to-spend.

- One HYSA for deposits (compare rates first).

- A scholarship spreadsheet template.

Moderate setup (balanced control)

- AI money-management wallet for forecasting and nudges.

- HYSA marketplace to move short-term funds.

- Scholarship aggregator + tracking sheet.

- Loan marketplace bookmarked for readiness.

Full setup (active planning)

- Forecasting tool that models scenarios.

- HYSA ladder for short-term deposits.

- Brokerage/529 for long-term growth.

- Scholarship automation + essay library.

- Loan comparison tool for contingency planning.

Where Beem fits in the toolbox

Beem Smart Wallet

Beem is a money-management tool powered by AI that helps users save, spend, plan and protect their money better. It helps balance spending with saving while enhancing bill payments, expense tracking, and payment planning. Use it to model cash flow for tuition deadlines, set reminders, and get AI nudges to prevent timing mismatches.

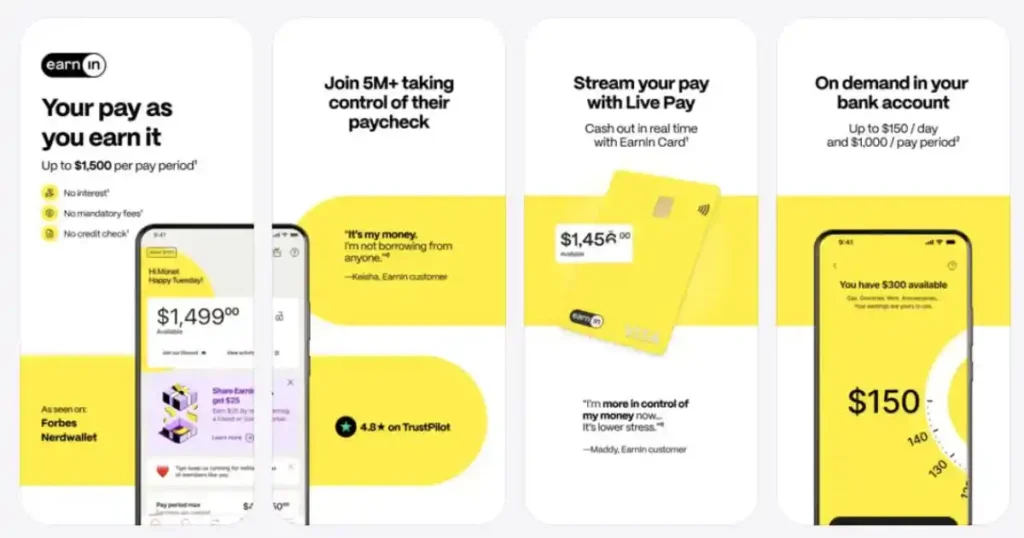

Beem Everdraft™

When a true emergency or timing gap threatens essentials, Everdraft™ is a solid, reliable financial safety net that provides up to $1,000 as instant cash, with no interest and no credit checks for eligible users. Treat it as a dependable bridge, and pair any draw with an immediate repayment automation and buffer rebuild.

Beem marketplace

Use it to compare personal loan offers and competitive high-yield savings accounts side-by-side so you can choose lower-cost options quickly.

These components are designed to help you avoid last-minute, high-cost decisions and preserve options while building steady progress toward college funding goals.

Choosing tools by planning horizon

- 0–3 years (near term). Prioritize liquidity and low volatility. HYSA + forecasting is key.

- 3–7 years (medium term). Blend HYSA for deposits and conservative investments for growth.

- 7+ years (long term). Give weight to tax-advantaged accounts and diversified investments; use forecasting tools to model different college cost trajectories.

(If you park short-term deposit cash in a HYSA, compare rates periodically. Small APY gaps matter over 1–3 years.)

Security and privacy checklist for tool selection

- Always use read-only bank connections where available.

- Prefer tools with two-factor authentication and clear privacy policies.

- Keep a local encrypted copy of crucial documents (scholarship receipts, tuition agreements).

- Limit write access for apps that can move money automatically unless you trust the workflow completely.

How Data Visualization Is Changing Family Financial Decisions

Numbers can be intimidating, especially for multi-year plans like education. In 2025, the best financial tools are translating complex data into clear visuals. Instead of spreadsheets filled with cells, you now get color-coded charts that show tuition progress, scholarship probability, or upcoming expenses in one view.

Modern dashboards let families simulate future cash flow, visualize savings gaps, and see the impact of one extra transfer per month in seconds. Visual learning turns abstract discipline into concrete motivation, and that’s often the missing emotional piece of planning.

If you’re using a budgeting or AI tool, enable visual progress charts and milestone tracking. It makes decision-making faster, calmer, and more aligned between parents and students.

How Smart Automation Reduces Planning Stress

Automation isn’t just about convenience; it’s about emotional relief. The best education-planning tools today do three things:

- Automate recurring transfers (so saving becomes invisible and consistent).

- Trigger micro-savings from cashback or round-ups.

- Send proactive alerts when balances or due dates approach.

These systems remove the guilt cycle (“we should save more”) and replace it with confidence (“we already are”). Beem’s Smart Wallet, for example, automates these planning habits intelligently, not just tracking bills but balancing payments, savings, and expenses in harmony.

The future of financial confidence isn’t about more apps; it’s about fewer manual decisions.

Accessibility: Tools That Work for Every Family Type

Educational planning tech often assumes stable income or two-parent households, but the 2025 landscape is becoming more inclusive.

The latest AI-driven tools can adjust goals dynamically for variable income, shared custody, or multi-household planning, perfect for single or blended families.

Features like joint dashboards, permission-based sharing, and dual-login options allow parents, guardians, or sponsors to collaborate transparently without friction.

For example:

- A separated family can share tuition goals without revealing full financial data.

- Guardians can monitor scholarship progress or savings without controlling accounts.

Inclusive design ensures that no household setup becomes a barrier to higher education.

The Psychology of Digital Planning: How Motivation Tools Keep You Consistent

Most people don’t fail to plan. They fail to stay consistent. That’s where behavioral design meets fintech. Apps today integrate gamification and habit reinforcement: badges for hitting monthly goals, milestone reminders, or encouraging notifications that celebrate progress.

This psychological layer matters. A 1% monthly increase in savings due to improved engagement compounds dramatically across 10 years.

Some apps also link emotional motivators, like future school milestones or dream university photos, to make the plan feel real, not abstract.

The takeaway: use tools that don’t just calculate, but coach.

Workflow examples: 3 real-life mini-routines

Weekly (10 minutes)

- Check the cash-flow forecast for the next 14 days.

- Confirm next scheduled transfers are queued.

- Note any scholarship deadlines in the coming week.

Monthly (20–30 minutes)

- Reconcile main app balances.

- Move windfall or cashback into HYSA or the education ledger.

- Run a quick subscription/recurring charge scan to cut low-value items.

Quarterly (45–60 minutes)

- Re-run scenario forecasts for tuition increases and adjust monthly savings.

- Shop HYSA rates in a marketplace and reallocate short-term funds if you find a better rate.

- Apply to 4–6 reasonable scholarship opportunities.

Cost vs benefit: do you need premium tools?

Premium tools pay for themselves when they: reduce fee drag, prevent late fees, surface a scholarship you otherwise miss, or save you a percentage point in borrowing cost. Start free, validate the ROI after 3 months, then upgrade where the benefit is clear.

Common tool mistakes and how to avoid them

- Too many apps, no single truth. Pick the primary view and consolidate.

- Treating alerts as plans. Alerts are prompts. Make decisions, then automate them.

- Ignoring fees. Small recurring fees erode savings; check app pricing and HYSA fine print.

- Over-reliance on autopilot without verification. Review AI suggestions monthly.

Tool roles at a glance

| Role | What to look for | Example benefit |

| Budget & forecasting | Read-only bank links, 30–90 day forecast, AI nudges | Avoid tuition timing gaps |

| HYSA marketplace | APY, fees, FDIC/NCUA, transfer limits | Higher yield on deposits |

| Scholarship tracker | Deadline automation, essay library | More and faster applications |

| Loan marketplace | APR, fees, term, co-signer options | Lower borrowing cost if needed |

| Receipt/records | OCR, export to CSV/PDF, tagging | Easier 529/documentation audits |

(Compare HYSA offers periodically, since small APY differences matter for short-term parking.)

Getting started: A 30-day tool plan

Day 1–3. Pick one budgeting/forecasting tool and connect accounts in read-only mode.

Day 4–7. Open or identify one HYSA for deposits; compare rates in a marketplace.

Day 8–15. Build a 90-day tuition cash-flow forecast; schedule a monthly transfer.

Day 16–30. Identify 3 scholarships to target and automate reminders; set a rule to route cashback/windfalls to HYSA.

Pick tools that remove friction, not add it

The best tools shorten decision loops, keep a clear record, and help you act before stress builds. Start with one reliable dashboard, park near-term funds in competitive HYSA options found through a marketplace, systemize scholarship work, and have a contingency plan for true emergencies. Use AI-powered helpers to spot risks early, and when needed, rely on a dependable short-term safety net like Beem Everdraft™ responsibly while you automate repayment and rebuild buffers. Small systems, repeated, beat heroic saves.

FAQs on Educational Planning

Which single tool should I start with for education planning?

Start with a forecasting-focused budgeting app or wallet that shows safe-to-spend and upcoming payment windows. If you’re short on time, one clear forward-looking number beats many category charts.

How often should I re-shop HYSA or loan offers?

Check HYSA rates every 3–6 months and loan marketplaces before any borrowing decision. Rates and promotions change; re-shopping can yield better returns or lower borrowing costs.

Can AI tools replace a financial advisor for education planning?

AI tools are powerful for modeling scenarios and surfacing options, but they don’t replace human judgment about family priorities, tax strategy, or complex aid negotiation. Use AI for analysis and speed, and consult an advisor for high-stakes, nuanced decisions.