Table of Contents

Paycheck gaps affect more people than we notice because it has become an invisible struggle. A gap doesn’t always mean lack of income. Most of the time, it means income arriving after the bills are due, or spending happening before a deposit hits the account. When this mismatch repeats, it quietly drains emotional energy and disrupts daily life.

Artificial intelligence has moved money management from hindsight tracking to foresight planning. AI tools inside financial apps look for patterns such as when money typically arrives and when expenses repeatedly hit the account. The real intent of AI in payday forecasting is to help users detect imbalance before it feels urgent. By showing short-cycle insights early, AI helps people take protective steps instead of feeling stuck in last-moment money stress.

The goal of this blog is simple. It is to help everyday earners use AI not just to predict paycheck gaps, but to prevent them from happening in the first place. AI is not a replacement for personal planning. It is a mental support system that improves clarity, reduces repetitive stress, and helps people budget in a calmer, smarter way.

AI Is Changing How We Understand Money Timing

Patterns Over Payday

Traditional banks assume income means salary, and salary means one credit every month. But AI-based apps look beyond that fixed cadence and learn deposit behavior from the user’s own activity. When it knows how you earn and spend, timing mismatches become easier to notice early.

AI tracks patterns like:

- rent or EMI dates repeating every month

- streaming and subscriptions hitting specific weeks

- freelance payments arriving on certain weekdays

- spending waves that drain balance early

This shifts money awareness from calendar-based guesswork to behavior-based preparation.

A Gap Starts in the Mind First

Most gaps begin as worry before they begin as a transaction failure. AI helps by bringing that moment of clarity sooner. Seeing a low-balance window forecast before the worry spiral begins changes the emotional impact of money management.

The benefit isn’t just convenience. It is emotionally calm. Users can plan ahead when the app shows timing mismatches clearly. This reduces the feeling of surprise that paycheck gaps once carried.

AI Makes Patterns Visible Without Shame

AI doesn’t label users or judge the habits it identifies. It simply shows patterns as they exist. This reduces emotional resistance and helps people look at gaps objectively without feeling guilty for experiencing them repeatedly.

Money stress used to feel personal because patterns were invisible. AI fixes this by turning unseen timing mismatches into visible insights. This allows users to prevent imbalance without self-blame taking over the journey.

How AI Predicts and Prevents Paycheck Gaps

Intelligent Income Recognition

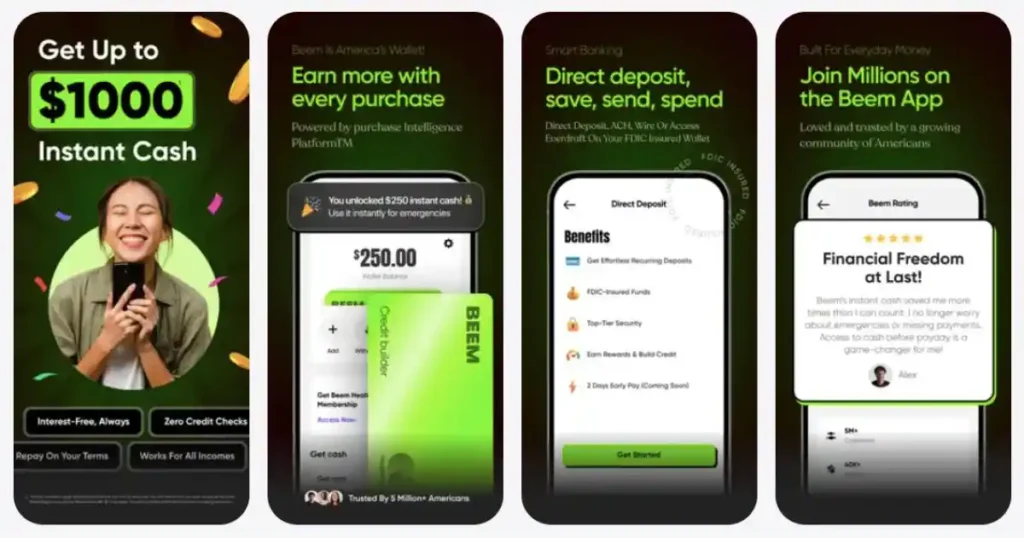

AI finance apps map income behavior based on real credits instead of fixed salary assumptions. Beem focuses on income recognition for independent and non-monthly earners by studying deposit timing and average leftover safe balance after each payout.

It looks for signals like:

- average credit timing

- minimum safe balance after deposit

- gap days before next credit arrives

- buffer suggestion required

This clarity helps customers plan bills without repeating steps manually.

AI doesn’t just detect deposit cycles. It also compares upcoming bills against expected credits. This makes financial planning easier for people paid per ride, delivery, or freelance gig, instead of one monthly statement.

AI That Offers Protection, Not Panic

The stress around paycheck gaps increases when the problem feels uncontrollable. AI reduces that stress by adding visibility and suggestions early. This helps people move from emotional tracking to practical preparation without feeling overwhelmed.

Predictive AI tools:

- recognize spending waves

- detect upcoming imbalance zones

- explain cash-flow suggestions clearly

- deliver reminders close to income timing

This reduces panic-based decisions.

Why AI Prediction Feels Better Mentally

Prediction helps people feel prepared instead of trapped. When mismatch days are shown before the bills land, customers don’t run mental loops calculating worst outcomes alone. This relieves emotional weight early.

Financial tools use:

- behavioral scanning

- bill timeline forecasting

- small buffer suggestions

- early earned income visibility

This changes the way users feel about planning ahead.

AI prediction respects a simple rule. The unknown hurts more than the math. Once timing becomes known earlier, planning becomes possible without emotional fear controlling the journey.

This builds confidence because the gap is spotted before the customer feels mentally tired from overanalysis. The mind gets relief before the balance even changes.

Prediction Turns Into Prevention When Used Daily

Seeing gaps earlier helps users take action calmly. When gap risk windows show up even before a user asks, prevention begins without repeated identity or income entry loops.

AI helps prevent mismatch by:

- forecasting recurring bills early

- computing gap days before deposit

- suggesting micro buffers logically

- monitoring without intrusive prompts

This makes prevention sharper. Daily use also helps users treat paycheck forecasting as a habit, not an emergency tool saved for anxious days. When insights arrive earlier and repeatedly, the brain trusts the pattern and planning becomes calmer. Over time, gaps reduce not because income increased instantly, but because timing intelligence improved consistently.

Check out Beem for on-point financial insights and recommendations to spend, save, plan and protect your money like an expert.

AI Makes the Advice More Human, Not Synthetic

Older banking systems pushed scripted, generic alerts. Today AI tools inside financial apps speak with contextual relevance. For example, if grocery and commute transactions spike mid-week before payment credits, AI surfaces insights tied to buffer suggestions.

This makes alerts feel:

- practical

- empathetic

- well timed

- easy to understand

Instead of reacting like a scripted bot that fires the same line every time, intelligent systems adapt to spending rhythms, bill timing, and balance behavior. When advice is practical, timely, and easy to understand, it feels less like tech talking and more like a smarter version of you thinking alongside you. This is how AI moves from sounding synthetic to sounding supportive.

The Emotional Win Comes First

Rocket Money shows users recurring bills before a gap hits. When patterns align, emotional breathing space increases.

This reduces:

- overspending stress

- payable date anxiety

- credit timing fears

- sleep disturbance from tracking

Mental peace improves financial decision-making.

AI-supported suggestions don’t prevent financial challenges fully, but it prevents overwhelming financial unpredictability. The user no longer feels trapped between cycles. The user feels supported between cycles.

Building Systems to Prevent Paycheck Gaps

Automation That Acts at the Right Time

AI systems allow rule-based automation instead of manual intervention every time. Chime uses automated cycle timing that helps users manage payments logically.

Automations can:

- schedule bills closer to deposits

- forecast smallest safe buffer days

- send real-time payable reminders

- link savings to real credits

This makes systems more protective emotionally. AI helps build systems that move money safely without judgment. When bills, deposits, reminders, and small cash buffers are forecast comfortably, automation begins acting as a stress preventer rather than just a convenience feature.

A well-timed system reduces cognitive load faster than savings by themselves. The brain stops looping calculations. The structure itself feels emotionally supportive.

You’re not waiting for money. You’re preparing for money. And that intent shift makes the mental experience calmer long before the financial outcome fully resolves.

System Over Balance Logic

The intent is to protect the customer from surprise loops. AI structures the logic without emotional friction.

Users feel prepared because:

- payday mismatch days are previewed earlier

- small emergency buffers aren’t interest-based

- cognitive loops are eliminated

- advice syncs to actual spending behavior

This stops stress repeating blindly.

Traditional banking helped customers after a gap happened. AI banking helps customers before a gap happens. This shift protects emotional energy, sleep patterns, and spending impulses that often cause imbalance to amplify mid-cycle.

Predictability Rebuilds Confidence

AI predictability does something banks once struggled with. It rebuilds confidence earlier by making spending behavior feel manageable instead of surprising. When finance tools provide early gap windows before payments land, customers feel in control.

This encourages:

- calmer financial language

- better budgeting decisions

- improved sleep timing

- fewer emotional anger triggers

- stronger productivity

Timing alignment becomes emotional alignment. When predictive analytics becomes part of an everyday finance experience, predictability stops being an abstract idea. Seeing patterns such as bill timing or paycheck mismatch windows early helps users feel more in control. Apps that are AI driven rebuild confidence not by motivational messaging, but by showing what is likely to happen before it happens.

Conclusion

Paycheck gaps are more about poor timing than poor discipline. The intent of AI-based finance tools is to give customers prediction clarity so imbalance is spotted earlier. The benefit users feel first is not the increase in the balance, but the reduction in fear, overanalysis, sleep disruption, and cognitive anxiety around income mismatch.

By using AI planning tools such as Beem, financial planning becomes smoother. Suggestions, bill previews, and micro cash buffers align to actual earning behavior, especially for short-cycle earners, freelancers, and gig workers. The gap stops feeling sudden. The stress stops repeating blindly. The mind stops keeping the score silently. AI doesn’t fully stop challenges, but it fully stops surprise loops.

The real reinvention is not just customer experience, it is customer confidence restored through clarity before urgency.

FAQs on How to Prevent Paycheck Gaps

How does AI help predict paycheck gaps?

AI reads recurring credit patterns, spending waves, and bill timing behavior inside banking apps such as Beem. It forecasts the mismatch days and highlights imbalance windows early enough for the user to plan rational buffers. This reduces last-minute surprises and helps users take action with clarity, not assumption. The system becomes proactive, not reactive, giving customers foresight to adjust payments before the stress begins repeating.

Can AI prevent paycheck mismatches completely?

AI cannot remove expenses or control income arrival, but it can prevent the emotional and cognitive impact of not planning earlier. Tools from apps like Rocket Money and Chime help by recognizing bill cycles early, bundling reminders, previewing gap days, and recommending rational small buffers before a cash shortage happens. When AI suggestions are used regularly, gaps become less disruptive and less frequent. Users make better decisions because the stress is detected sooner, not exaggerated later.

Are micro cash buffers safe in AI-assisted banking?

Yes. AI recommends small rational advance or buffer suggestions based on what users can safely return without interest stress amplifying the situation. The intent is not to create credit dependence, but to support timing mismatches such as groceries, commute, fuel, or predictable bills landing before the next credit. No hidden penalties. No emotional loan loops. Clear limits explained before access. Prevention without financial traps makes customers confident instead of reactive.

Who benefits most from AI paycheck insights?

Freelancers and gig earners benefit significantly because their payout timing varies by weekday, hours, and weekly cycles instead of monthly assumptions. AI connects multiple payout signals to forecast mismatch days early so payments can be rescheduled or supported by rational micro buffers before anxiety begins controlling the journey. Prioritized reminders, income mapping, and gap insights sync to real earning cycles. This turns uncertainty into visibility. Visibility into preparedness. Preparedness into better emotional and financial decisions.

Will AI assistants replace human financial planning?

No. AI strengthens human decisions by forecasting upcoming imbalance days early with clarity. The intent is to stop repetitive cognitive stress loops, highlight recurring bills sooner, and offer rational suggestions based on earning behavior. The user still makes the final decision. AI removes overmonitoring exhaustion without removing personal agency. It makes planning better, sharper, and less stressful, keeping the human at the center of the financial journey instead of the calendar at the center.