Ads are always designed to manipulate spending habits and prompt emotional buying. Emotional spending is when you buy something you don’t need as a result of feeling stressed out, bored, under-appreciated, incompetent and unhappy or any other emotion. Some of us even spend emotionally when we’re happy.

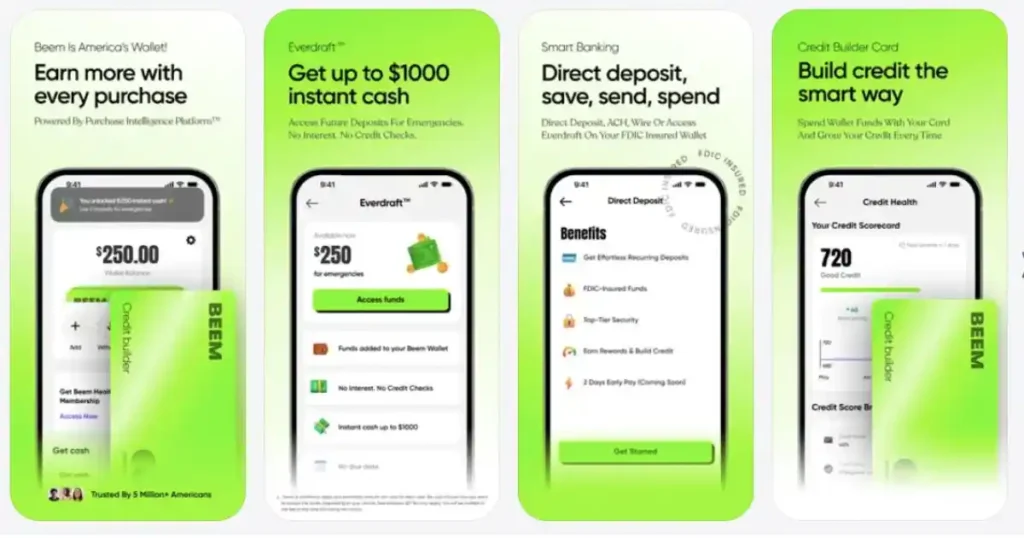

While Cash Now Pay Later by Beem is always there to satisfy your financial need of the hour, you might want to rethink where you want to spend it. And we’re here to help you figure out how not to use CNPL.

Get your priorities right

Hold yourself accountable for your spending. The Beem app is your best financial friend that way. While you have access to CNPL, you can even save, spend, plan and protect your finances with Beem.

With quick and easy cash made available at your disposal, you will need some willpower to hold back on your spending. So, when willpower has its limits, push yourself to stay financially focused!

Start with making a list of your financial priorities. Place the list where you can see like the refrigerator door or the bathroom mirror. Also, make a second copy for your wallet! Just a little reminder for every time you pull out some cash. You can even take it as sticky notes on your credit cards. It may send off crazy vibes to people around you, but it will help you save. And that’s the goal at the end of the day.

Avoid impulsive buying

No, we’re not telling you to avoid buying gum in the checkout Beem at the grocery store. But whenever you’re shopping and you find yourself wanting to buy something you didn’t already want before you start shopping, don’t buy it!

Wait at least 24 hours, if not longer, rethink before making a decision about whether to buy the item. You might want to even go through your dues and see if you could put CNPL to some good use. Always pay attention to the nagging voice in your head that is telling you that you don’t need to make that purchase.

Don’t let ads get to you

Take steps to intentionally limit your exposure to advertisements. The less you are aware of what’s available for you to buy, the less likely you spend. Unsubscribe to those product catalogues that arrive in your mailbox and promotional emails. Always keep the ad man at bay!

Walk away from temptation, deliberately

Once ads are out of sight and out of mind, take steps to limit your exposure to places and situations that tempt you to spend. Maybe that trip to the mall can reduce from multiple times a month to once a month. If it’s online shopping, find something else to replace your time on the Internet.

The bottom Line

The goal here isn’t to stop you from buying anything fun. If we didn’t buy enjoyable things (occasionally) with our money, let’s be honest, getting up and going to work every day will be a task!

However, becoming more conscious of your shopping habits will help you control your finances better. You can finally enjoy your purchases without dreading the guilt of having spent too much.