Table of Contents

If you’re trying to improve your credit score, the one factor you can’t afford to ignore is your credit utilization ratio. It’s often the silent driver behind sudden drops or gains in your score, sometimes even more impactful than making a payment on time. While many credit-conscious individuals focus primarily on payment history, understanding and managing your credit utilization can be a game-changer. The role of credit utilization ratio in your credit score is significant—it reflects how much of your available credit you’re using. High utilization can signal risk to lenders even if you’ve never missed a payment.

This guide will explain everything you need to know about credit utilization — what it is, why it matters, how it’s calculated, and how to use it to your advantage. We’ll also share actionable tips and explain how Beem’s credit monitoring tools make staying on top of utilization easier than ever.

What Is Credit Utilization Ratio and How Is It Calculated?

Your credit utilization ratio tells lenders how much of your available revolving credit you’re currently using. Revolving credit includes credit cards, lines of credit, and similar accounts whose balance fluctuates monthly.

The Formula:

Credit Utilization Ratio=(Total Credit Card BalancesTotal Credit Limits)×100\text{Credit Utilization Ratio} = \left( \frac{\text{Total Credit Card Balances}}{\text{Total Credit Limits}} \right) \times 100

Practical Example:

Imagine you have three credit cards:

- Card 1: $4,000 limit, $800 balance

- Card 2: $3,000 limit, $1,200 balance

- Card 3: $2,000 limit, $400 balance

Total available credit = $9,000

Total balances = $2,400

Credit Utilization Ratio = (2,400 / 9,000) × 100 = 26.7%

Why Credit Utilization Ratio Is So Important

Credit utilization is roughly 30% of your FICO® Score — second only to payment history. It’s a powerful indicator for lenders of your dependency on borrowed money.

- Low utilization suggests financial discipline and low risk.

- High utilization can signal financial stress and increased default risk.

Think of it like your credit ‘usage meter’. The lower it stays, the better your credit looks.

Read related blog: How to Improve Credit Utilization to Boost Your Credit Score Fast

The Difference Between Individual Card and Overall Utilization

Your credit utilization is evaluated at two levels:

Individual Card Utilization

If you max out one card, it can harm your score even if your total utilization across all cards is low. For example, maxing out a $1,000 limit card while keeping others at zero can negatively affect your score.

Overall Utilization

This measures your total balances relative to total credit limits across all cards. Keeping your overall utilization low shows you’re not overextended.

Ideal Credit Utilization Ratio: How Low Is Low Enough?

While experts commonly advise keeping utilization under 30%, aiming for under 10% can boost your score. If your total available credit is $10,000, try to maintain balances under $3,000 — ideally under $1,000.

Many high scorers maintain very low utilization ratios, even below 5%. This signals to lenders that you rarely rely on credit for everyday spending and manage your finances responsibly.

When Does Your Utilization Ratio Get Reported?

Your credit card issuer reports your balance and credit limit to the credit bureaus monthly, usually around the statement closing date — not the payment due date.

This means that if you pay your balance after the closing date but before the due date, the higher balance at closing is reported and reflected in your utilization ratio.

How Often Does Your Credit Utilization Ratio Affect Your Score?

Credit scores typically update once every 30 days when new data is reported to bureaus. Your utilization ratio at the time of reporting impacts your next score update.

This explains why your score may fluctuate even if you consistently pay on time.

Read related blog: Lower Credit Utilization: The Easiest Way to Improve Your Credit Score

How to Lower Your Credit Utilization Ratio

1. Pay Down Balances Before the Statement Closing Date

Pay your credit card balances before the statement closing date to lower your reported utilization. This ensures the balance reported to bureaus is lower.

2. Request Credit Limit Increases

A higher credit limit with the same or lower balance reduces your utilization ratio. To avoid damaging your score, check that your issuer uses a soft inquiry for limit increases.

3. Spread Your Spending Across Multiple Cards

Avoid maxing out one card. Use several cards with lower balances to keep individual utilization ratios low.

4. Avoid Closing Old Cards

Closing credit cards reduces your total available credit, raising your overall utilization and hurting your score.

Credit Utilization and Its Relationship with Payment History

While utilization accounts for 30% of your score, payment history makes up 35%. Even with low utilization, missed or late payments can drastically hurt your score.

Conversely, a solid payment history can offset a higher utilization ratio, but keeping both in check is best.

Common Misconceptions About Credit Utilization

Myth 1: Carrying a Balance Improves Credit

Some believe carrying a small balance builds credit. In reality, paying off your balance in full and maintaining low utilization is best.

Myth 2: Total Utilization Is All That Matters

Individual card utilization impacts your score, too. Maxing out a single card can reduce your score even if your overall utilization is low.

Myth 3: Credit Utilization Only Applies to Credit Cards

It only applies to revolving credit, not installment loans like car loans or mortgages.

How Quickly Can Reducing Your Utilization Boost Your Score?

When you lower your utilization ratio — through paying down balances or increasing limits — you can see improvements in your credit score as soon as the next reporting cycle, typically 30 days.

Consistent low utilization over several months leads to stronger credit profiles.

Read related blog: Track and Improve Credit Utilization with Beem’s Tools

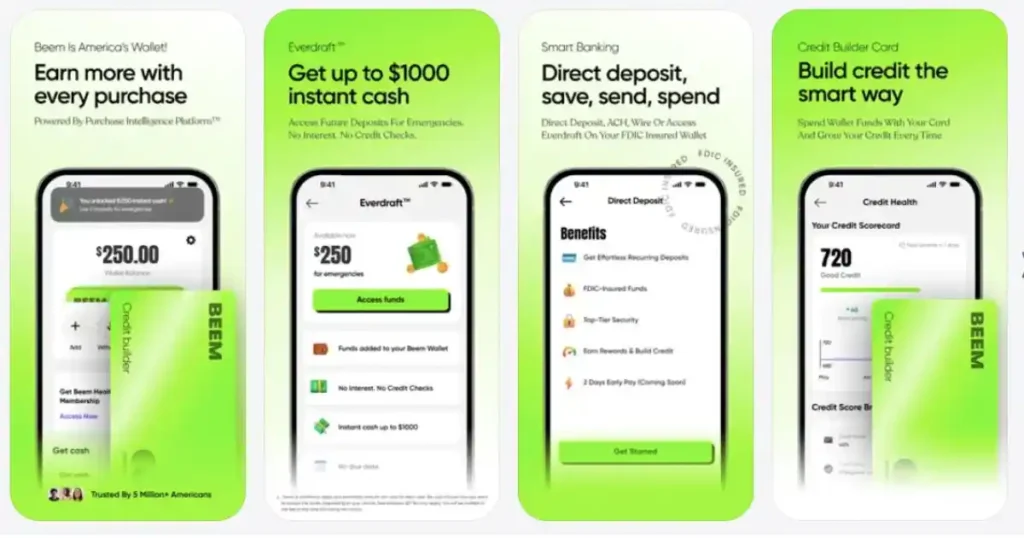

Beem’s Tools to Manage Credit Utilization Effectively

The credit monitoring platform by Beem makes it easy to keep utilization in check:

- Visual dashboards track your balances, limits, and utilization ratios

- Custom alerts notify you if utilization crosses risky thresholds.

- Score Simulator allows you to preview how paying down balances or increasing credit limits will impact your score

- Debt-to-income analysis to understand your overall financial health

With Beem, you have proactive tools to avoid credit surprises.

How Credit Utilization Impacts Other Credit Factors

High utilization can indirectly affect other factors, such as:

- Credit mix: If you close credit cards due to high balances, you might reduce your credit mix.

- New credit: Applying for new cards to increase limits can generate hard inquiries, temporarily lowering your score.

Understanding these relationships helps you plan credit moves wisely.

What Happens If Your Utilization Is Too High?

Using too much of your available credit can lead to:

- Lower credit scores, which may increase loan interest rates

- Credit card issuers reducing limits or closing accounts

- Higher risk of a debt cycle, making it harder to pay off balances

Tips for Those with Limited Credit Options

If you don’t have multiple credit cards or high limits, focus on:

- Using your cards responsibly and paying off balances monthly

- Considering a secured credit card with a higher limit

- Adding alternative credit data like rent or utilities through services that report to bureaus

- Using Beem to monitor your credit health closely

Read related blog: Common Credit Pitfalls to Avoid and How They Affect Your Score

FAQs on The Role of Credit Utilization Ratio in Your Credit Score

What is a good credit utilization ratio?

A good credit utilization ratio is generally under 30%. This means you use less than 30% of your available revolving credit. For the best scores, experts recommend keeping it below 10%. Low utilization signals lenders that you’re managing credit responsibly and not overextending yourself.

Does paying off my credit card balance in full help my utilization?

Paying off your balance before your statement closing date ensures the lower balance is reported to the credit bureaus, resulting in a lower utilization ratio. This can positively affect your credit score. However, paying after the statement closing date but before the payment due date may not lower the utilization reported for that month.

Will increasing my credit limit lower my utilization ratio?

Increasing your credit limit while keeping your balance the same lowers your credit utilization ratio, which can improve your credit score. Be sure to check whether the credit issuer performs a soft or hard inquiry when you request a credit limit increase, as a hard inquiry can temporarily lower your score.

Does credit utilization apply to loans?

No. Credit utilization only applies to revolving credit accounts like credit cards and lines of credit. Installment loans such as mortgages, auto loans, or student loans don’t impact your credit utilization ratio but influence your credit score in other ways.

How can Beem help me manage my credit utilization?

Beem consolidates your credit information, clearly displaying balances, limits, and utilization ratios. It sends you alerts if your utilization exceeds a set threshold, helping you take timely action. The Score Simulator lets you model scenarios like paying down debt or increasing credit limits so you can understand how your credit score might change without any guesswork.

Your Credit Utilization Ratio Is a Powerful Tool

Understanding and managing your credit utilization ratio is one of the most impactful steps you can take to improve your credit score. By keeping utilization low, paying your balances on time, and monitoring your credit carefully, you demonstrate to lenders that you’re a responsible borrower.

With Beem’s comprehensive credit monitoring and educational tools, you can keep utilization in check, avoid costly surprises, and make confident, informed financial decisions. Combine this with good payment habits, and you’ll be well on your way to a stronger credit profile and better financial opportunities. Download the app here.